Bitcoin’s ESG Potential: How It Can Attract $23 Trillion and Grow to $3.3 Trillion

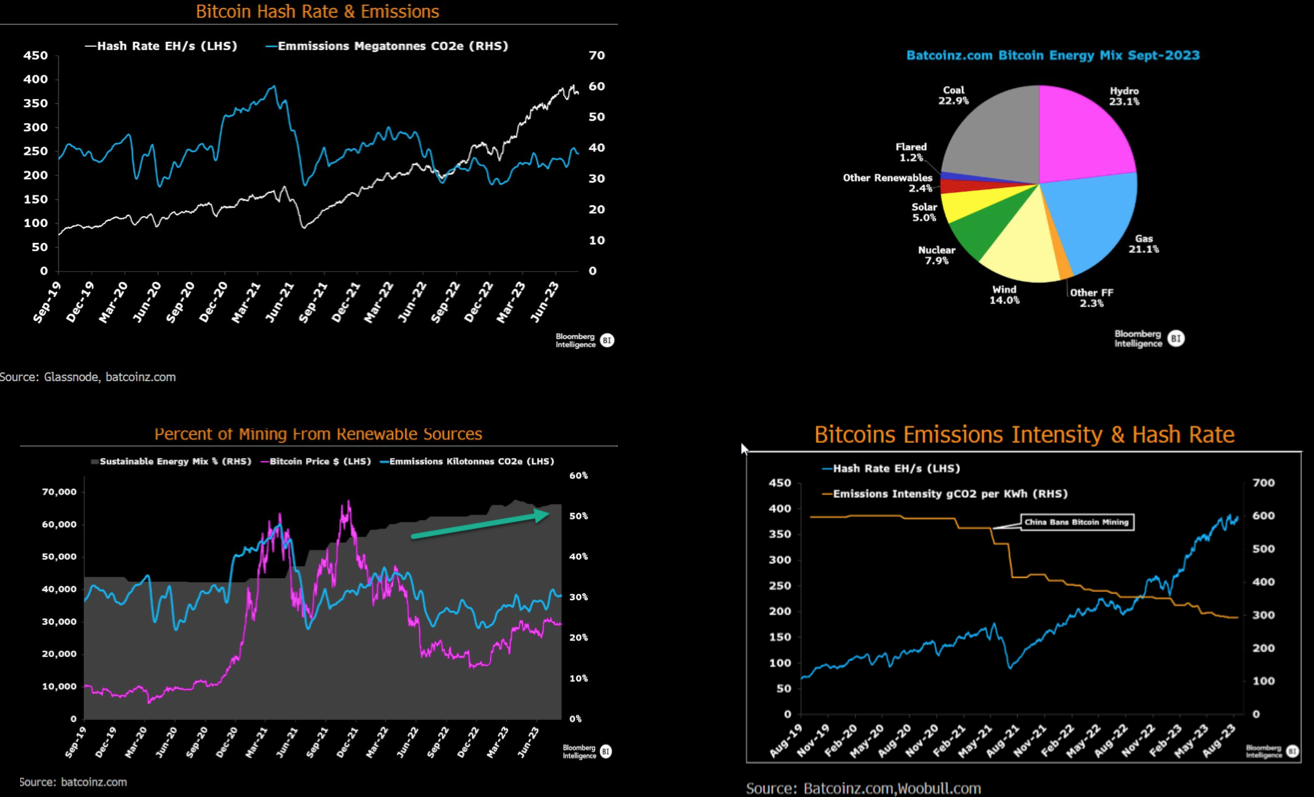

How Bitcoin Can Become the World’s Top ESG Asset Bitcoin, the leading cryptocurrency, has often been criticized for its environmental impact, social implications, and governance issues. However, a new research by Daniel Batten, a climate tech investor, Bitcoin environmental impact analyst, and CEO of CH4 Capital, challenges these narratives and positions BTC as the world’s premier Environmental, Social, and Governance (ESG) asset.

Batten’s research provides a detailed and data-driven perspective on Bitcoin’s potential to attract ESG funds, which are seeking sustainable investments that align with their values and goals. According to Batten, there are around $23 trillion locked in ESG funds, while BTC’s current market cap is only $724 billion. This presents a huge opportunity for Bitcoin to grow and become an institutional-grade asset, comparable to other assets that are usually measured in trillions.

He cites the analysis of Willy Woo, a prominent Bitcoin analyst and influencer, who argues that Bitcoin needs to stay above $1 trillion before the institutions that hold the wealth of nation states and/or retirement funds feel comfortable investing in it en masse. Batten proposes that a mere 1% allocation from ESG funds to Bitcoin could increase its market cap to approximately $1.68 trillion. An aspirational goal of 2.5% allocation could potentially skyrocket the market cap to around $3.3 trillion.

Batten explains that thanks to Woo’s analysis, he can forecast the impact of ESG fund inflows to Bitcoin within a range. According to the model, the price increase is between 1.30 and 4.80 dollars per dollar invested. This puts Bitcoin on the roadmap for institutional investors, who can benefit from its high returns and low correlation with other assets. As institutional investors invest into Bitcoin, this further increases Bitcoin’s market cap, and creates a positive feedback loop, catalyzed by initial engagement between the Bitcoin and the ESG community.

Batten also defends Bitcoin’s environmental, social, and governance credentials, and argues that it is the best ESG asset in the world. He claims that Bitcoin is environmentally friendly, as it incentivizes the use of renewable energy, reduces carbon emissions, and supports the transition to a low-carbon economy. He asserts that Bitcoin is socially beneficial, as it empowers individuals, fosters financial inclusion, and promotes human rights. He contends that Bitcoin is well-governed, as it is decentralized, transparent, secure, and resilient.

Pingback: BitGo CEO: SEC Won’t Approve Bitcoin ETFs Unless Exchanges and Custody Are Separate - cryptoS Report >> BTC, ETH & SOL...