How Bitcoin Mining Firms Performed in Q3 2023

Bitcoin mining is a crucial activity that secures and validates the transactions on the Bitcoin network. In this article, we will review the performance of some of the leading public Bitcoin mining companies in the third quarter of 2023, based on a report by Hashrate Index

The report covers various aspects of Bitcoin mining, such as the stock prices, the hashrate, the production, and the profitability of the mining firms. We will focus on four major players in the North American market: Marathon Digital, Riot Blockchain, Iris Energy, and Core Scientific.

Stock Prices and Bitcoin Price

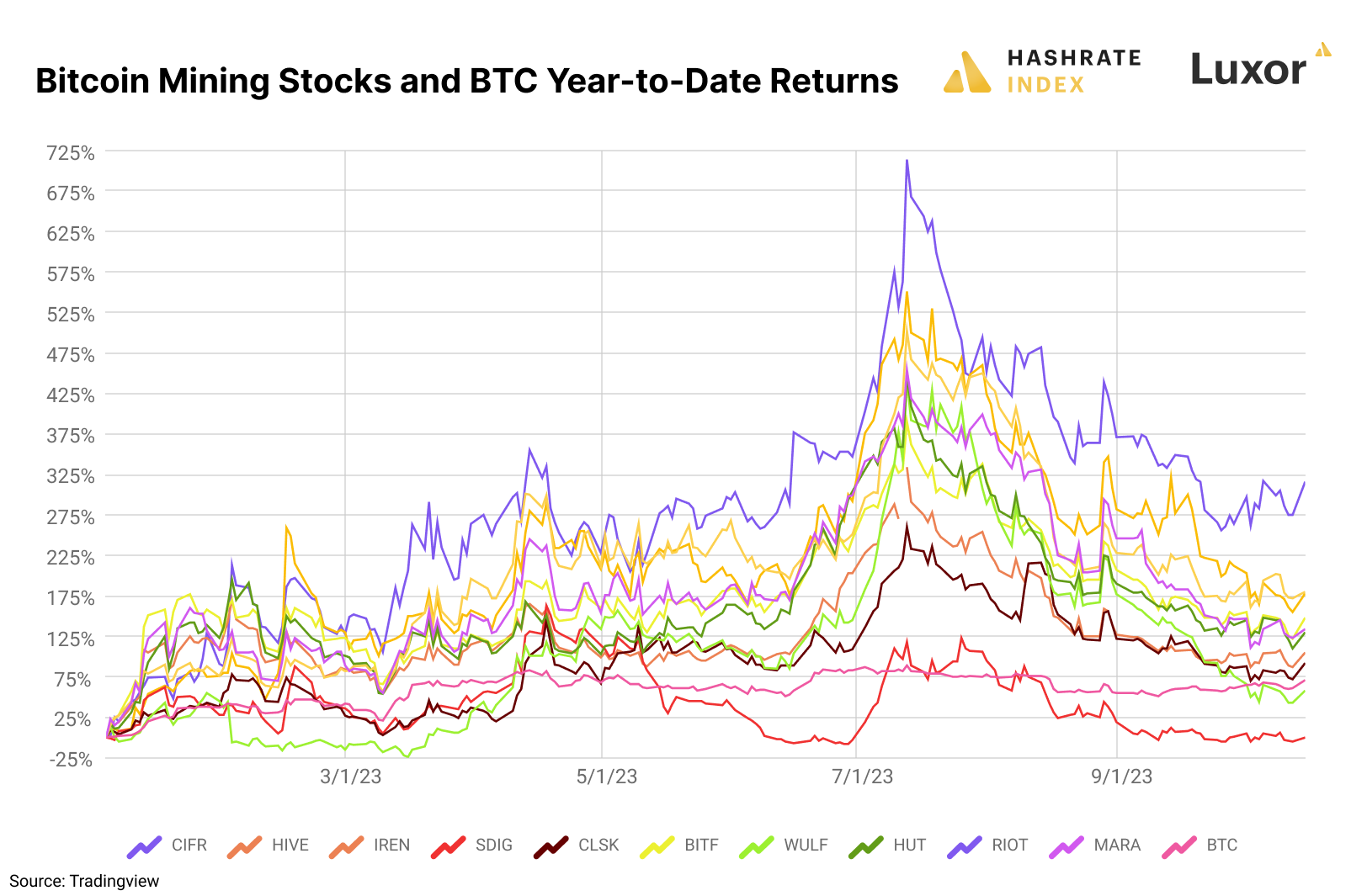

The stock prices of the public Bitcoin mining firms are highly correlated with the price of Bitcoin, which fluctuated significantly in Q3 2023. Bitcoin started the quarter at around $24,800 and reached a high of $27,500 in mid-September, before dropping to $26,000 by the end of the quarter. The mining stocks followed a similar pattern, with some variations depending on their individual performance and news.

Marathon Digital was the best performer among the four, with its stock price increasing by 18% in Q3 2023. Riot Blockchain was the worst performer, with its stock price dropping by 12% in the same period. Iris Energy and Core Scientific had modest gains of 4% and 2%, respectively.

Hashrate and Production

The hashrate is a measure of the computing power that secures the Bitcoin network. The higher the hashrate, the more secure and profitable the network is for the miners. The hashrate of Bitcoin increased by 12% in September, reaching an all-time high in mid-October. This was partly due to seasonal factors, such as lower temperatures and cheaper electricity in some regions.

Among the four mining firms, Marathon Digital had the largest active hashrate of 19.1 EH/s (exahashes per second) by the end of Q3 2023. It also increased its hashrate by 162% year-to-date (YTD), thanks to its aggressive expansion and acquisition of new mining machines. Riot Blockchain had the second-largest active hashrate of 16.6 EH/s, but it only increased its hashrate by 10% YTD. Iris Energy had a significant growth in its hashrate, from 1.57 EH/s to 5.55 EH/s YTD, while Core Scientific had a slight decline in its hashrate, from 8.7 EH/s to 8.4 EH/s YTD.

The production is the amount of Bitcoin that the mining firms generate from their operations. The production depends on several factors, such as the hashrate, the difficulty, the fees, and the halving. The halving is an event that occurs every four years, when the reward for each block mined is reduced by half. The last halving occurred in May 2020, reducing the reward from 12.5 BTC to 6.25 BTC per block.

Marathon Digital was also the leader in terms of production, with 2,252 BTC mined in Q3 2023. It also increased its production by 220% YTD, despite the halving effect. Riot Blockchain was second, with 1,789 BTC mined in Q3 2023, but it only increased its production by 26% YTD. Iris Energy and Core Scientific had lower production levels, with 722 BTC and 694 BTC mined in Q3 2023, respectively. They also had lower growth rates of 78% and -9% YTD, respectively.

Profitability and Outlook

The profitability of Bitcoin mining depends on several factors, such as the price of Bitcoin, the cost of electricity, the efficiency of the mining machines, and the competition from other miners. The report estimates that the average cost of electricity for the public Bitcoin miners was $0.04 per kWh (kilowatt-hour) in Q3 2023.

Based on this assumption, Marathon Digital was again the most profitable mining firm, with an estimated gross margin of 82% in Q3 2023. It also had an estimated gross profit of $116 million in Q3 2023, which was more than double its gross profit in Q2 2023 ($54 million). Riot Blockchain was second, with an estimated gross margin of 79% and an estimated gross profit of $92 million in Q3 2023. Iris Energy and Core Scientific had lower profitability levels, with estimated gross margins of 75% and 74%, respectively, and estimated gross profits of $37 million and $36 million, respectively.