BIS and European banks launch Project Atlas to monitor crypto and DeFi

The Bank for International Settlements (BIS) and several European central banks have announced the launch of Project Atlas, a joint initiative to collect and analyze data on crypto assets and decentralized finance (DeFi) platforms. The project aims to enhance the understanding and regulation of these emerging and fast-growing sectors.

The report proposes several policy recommendations to prevent similar crises in the future, such as:

- Developing a common framework for collecting and analyzing data on crypto and DeFi activities across jurisdictions.

- Enhancing the prudential regulation and supervision of banks that engage in crypto and DeFi activities, including setting appropriate capital and liquidity requirements, stress testing, and contingency planning.

- Establishing clear rules and standards for the issuance and governance of stablecoins, as well as ensuring their interoperability and convertibility with other forms of money.

- Promoting international cooperation and coordination among regulators, central banks, and other stakeholders to address the cross-border challenges posed by crypto and DeFi.

Project Atlas is expected to deliver its first results by mid-2024. The project is part of the broader efforts by the BIS and central banks to foster international collaboration on innovation and digital transformation in the financial sector.

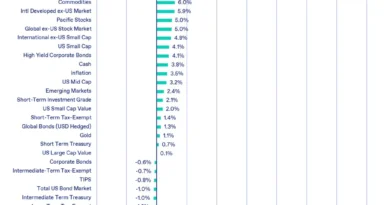

It will leverage the expertise and resources of the BIS Innovation Hub, the European Central Bank, and the central banks of Denmark, France, Germany, Italy, the Netherlands, Spain, Sweden, and Switzerland. The project will develop a prototype dashboard that will provide real-time information on the size, growth, and activity of crypto and DeFi markets. The dashboard will also include indicators of potential risks and vulnerabilities, such as liquidity, leverage, and market concentration.