Fidelity Investments’ Director of Global Macro on Bitcoin: ‘I Think of It As Exponential Gold’

Jurrien Timmer, the Director of Global Macro at Fidelity Investments, shares his insights on Bitcoin’s current market activity, drawing parallels with historical cycles.

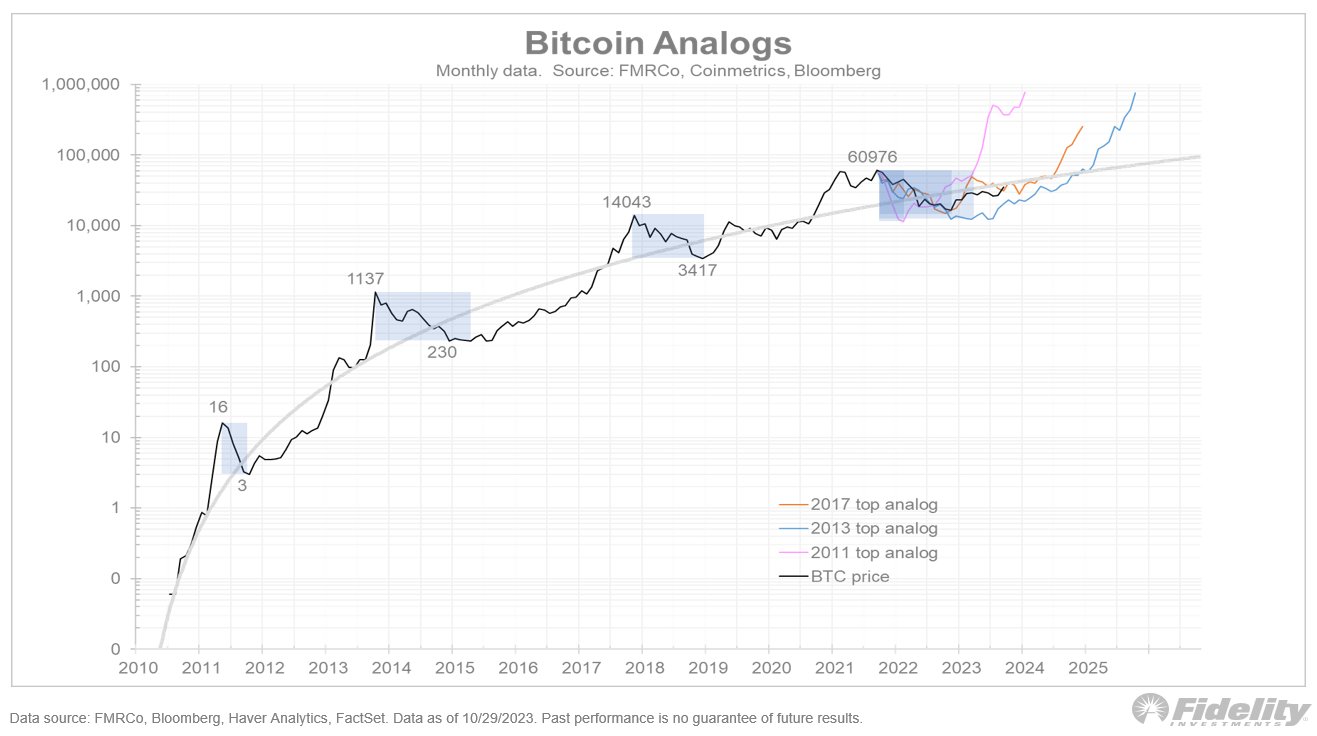

Bitcoin’s Cyclical Nature

He highlighted Bitcoin’s recent momentum, which seems to mirror the familiar cycles of boom and bust that the digital currency has experienced in the past. He invited his audience to consider the implications of this pattern.

Bitcoin as a Commodity Currency and a Store of Value

Timmer described Bitcoin as a “commodity currency” with aspirations of becoming a recognized store of value, offering protection against monetary debasement. He likened Bitcoin to “exponential gold,” suggesting that while gold is indeed a form of money, its practical limitations hinder its use as a medium of exchange.

He provided a historical context, noting that gold tends to prosper in economic climates where inflation is high, real interest rates are negative, and the growth of the money supply is deemed excessive. He cited the 1970s and the 2000s as periods when gold notably outperformed, gaining a larger share of the market relative to global GDP.

The Fidelity executive expressed optimism about Bitcoin’s potential to play a similar role to gold under these economic conditions. He teased a continuation of the discussion in a subsequent thread, promising to expand on the idea of Bitcoin being a viable player alongside gold.

Other Voices on Bitcoin

Timmer is not the only prominent figure in the financial world who has expressed interest in Bitcoin. At the Robin Hood Investors Conference sponsored by J.P. Morgan, held on 24-25 October in New York City, a conversation between billionaire hedge fund manager Paul Tudor Jones II and Stanley Druckenmiller, a legendary investor with an estimated fortune of $6.2 billion, captivated attendees, particularly from the crypto community.

Druckenmiller shared his concerns about potential economic disruptions in the U.S., hinting at a possible involvement of the stock market as early as 2024. He noted recent anecdotal signs of a softening economy based on his observations over the past five weeks.

He discussed the stock market, commenting on the Biden Administration’s economic stimulus measures. While acknowledging their potential to create investment opportunities, he also warned that they could exert pressure on interest rates and lead to market disruptions.