These 3 Cryptos Have Been on Fire in 2023: Find Out What Makes Them So Special

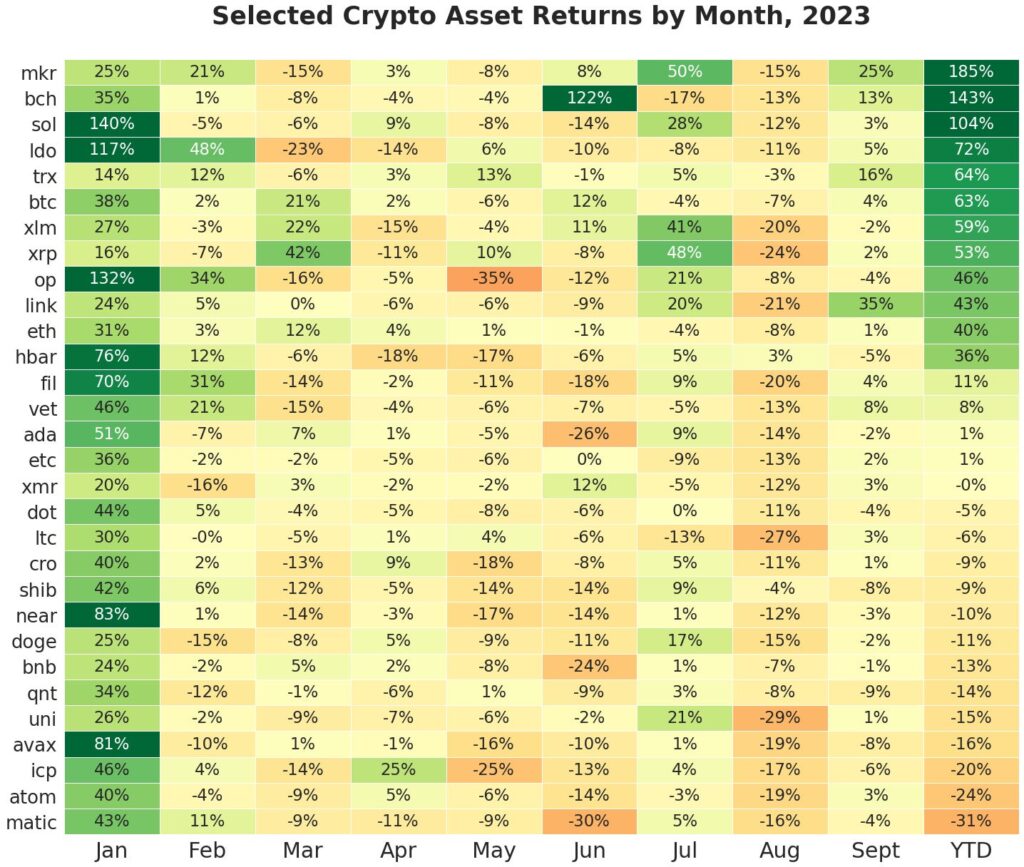

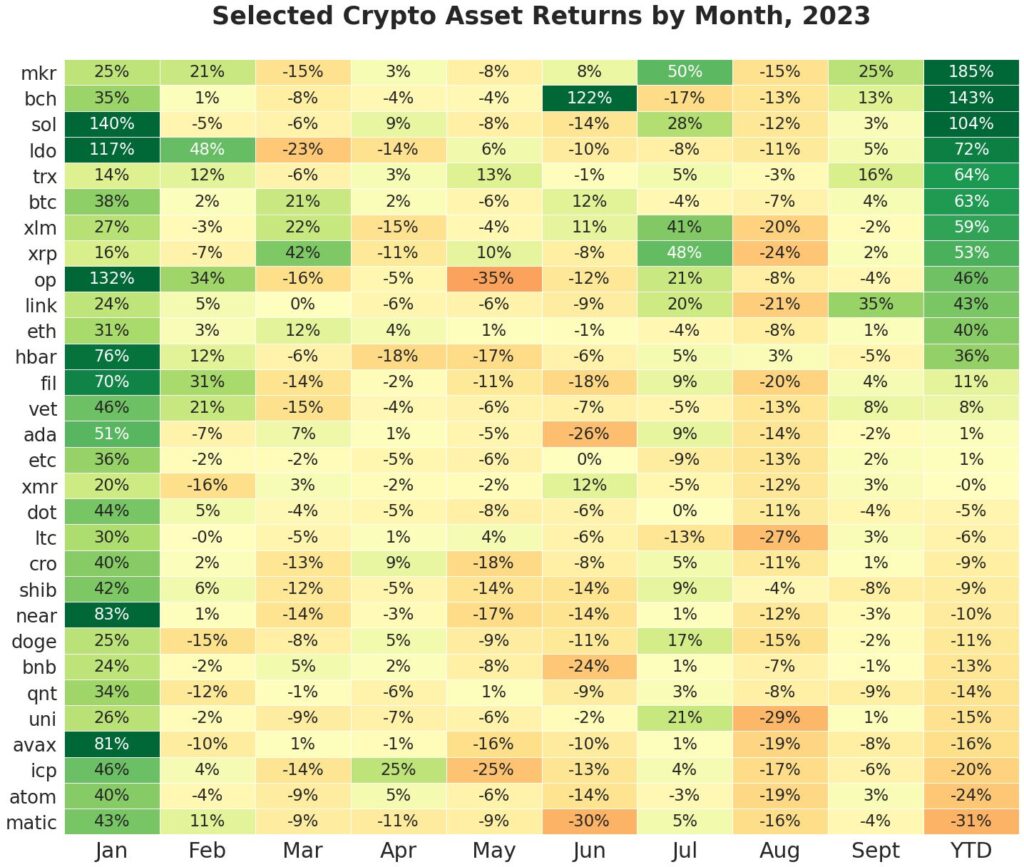

The cryptocurrency market is full of surprises and opportunities for investors who are willing to take risks and explore new horizons. Among the hundreds of coins available, some have shown remarkable performance and resilience in 2023, despite the volatility and uncertainty. In this article, we will look at the three best-performing cryptocurrencies out of the top 100 by market capitalization in 2023. According to CoinMetrics: Maker Protocol: +185% YTD, Bitcoin Cash: +143% YTD and Solana: +104% YTD

Solana ($SOL):

Solana is a fast and scalable blockchain platform that supports smart contracts, decentralized applications, and cross-chain interoperability. Solana has attracted a lot of institutional interest, especially after partnering with Visa, a global payment giant. Solana has also seen a surge in its total value locked (TVL), which measures the amount of assets locked in its decentralized finance (DeFi) protocols. Solana’s TVL reached a 2023 high of $338.82 million, according to DefiLlama1. Solana’s native token, SOL, has increased by over 700% in 2023, reaching a market cap of $1.2 billion.

MakerDAO ($MKR):

MakerDAO is a decentralized autonomous organization (DAO) that governs the Maker Protocol, which allows users to create and manage a stablecoin called DAI. DAI is pegged to the US dollar and backed by various crypto assets as collateral. MakerDAO also enables users to access various DeFi services, such as lending, borrowing, and saving. MakerDAO’s co-founder, Rune Christensen, recently proposed a major overhaul of the Maker Protocol, which involves migrating to a new blockchain based on Solana’s codebase2. MakerDAO’s native token, MKR, has risen by over 400% in 2023, reaching a market cap of $1 billion.

And we’re not really sure why Bitcoin Cash ($BCH) performs so well but here are some possible reasons:

- Bitcoin Cash is a fork of Bitcoin that aims to offer faster, cheaper, and more scalable transactions. Bitcoin Cash has a larger block size limit than Bitcoin, which allows it to process more transactions per second. This could make Bitcoin Cash more attractive to users and merchants who value speed and low fees.

- Bitcoin Cash is supported by a loyal and passionate community of developers, miners, investors, and users who believe in its vision and potential. Bitcoin Cash has also received endorsements from some prominent figures in the crypto space, such as Roger Ver, Jihan Wu, and Kim Dotcom. These supporters could help Bitcoin Cash gain more adoption and awareness in the market.

- Bitcoin Cash could benefit from the upcoming halving in 2024, which is a process that reduces the reward for mining new blocks by half every four years. The halving is expected to create a supply shock and increase the scarcity and demand for Bitcoin Cash. The halving could also incentivize more miners to switch from Bitcoin to Bitcoin Cash, as the latter will have a higher profitability and lower difficulty.

- Bitcoin Cash could also benefit from the growth and innovation in the decentralized finance (DeFi) sector, which is a movement that aims to create open and permissionless financial services on the blockchain. Bitcoin Cash has several DeFi projects built on its network, such as AnyHedge, Detoken, and SmartBCH. These projects could increase the utility and value of Bitcoin Cash as a collateral, lending, and payment asset.