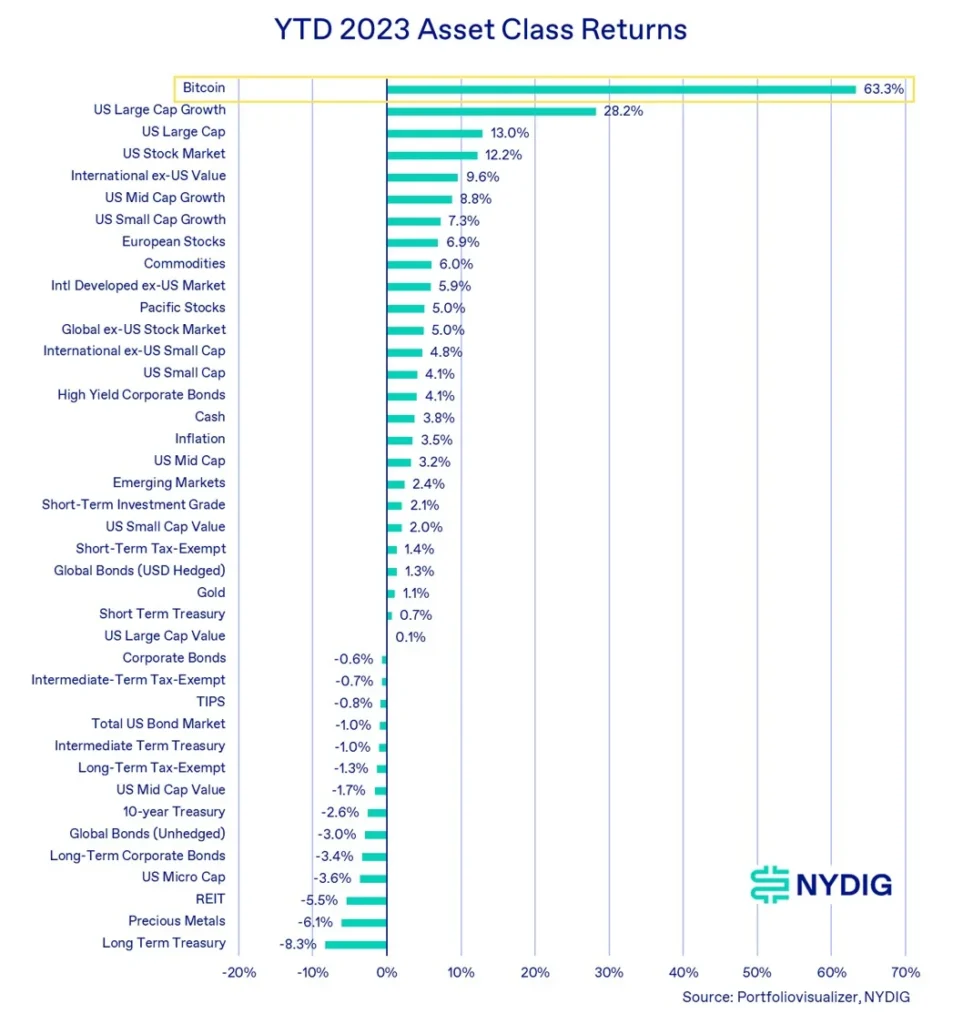

How Bitcoin Beat All Other Wealth Classes in 2023

Bitcoin has outperformed all other asset classes in 2023, rising by 60% in a year marked by economic uncertainty, high inflation, and rising interest rates. According to data published by NYDIG, bitcoin was the only asset among 40 wealth classes that posted a positive return in the third quarter, while stocks, bonds, commodities, and gold suffered losses.

Some of the main points are:

- Bitcoin gained 21.9% in the quarter, despite a challenging period for financial markets. The newsletter cites the banking crisis, the regulatory developments, and the cyclical nature of bitcoin prices as the key factors influencing its performance.

- It discusses the various reports and proposals released by regulators and agencies in response to the White House’s Executive Order on crypto. It suggests that greater regulatory clarity may require legislation, such as the stablecoin and digital commodities bills.

- The newsletter analyzes the trends and data related to bitcoin mining, such as hash rate, miner balances, and energy consumption. It notes that miners have recovered from the China ban and are expanding their operations in other regions.

- They introduce Taro, a new protocol that enables the creation of synthetic assets on Bitcoin and the Lightning Network. It explains how Taro works and what benefits it can bring to users and developers.

- The newsletter concludes with some bullish predictions for bitcoin based on historical patterns around halvings. It expects bitcoin to reach new highs by the end of 2024.

It attributes bitcoin’s resilience to its unique value proposition as a store of value, a hedge against inflation, and a decentralized alternative to the traditional financial system. Bitcoin also benefited from growing adoption by institutional investors, corporations, and governments, as well as technological innovations such as the Lightning Network and Taproot.

Pingback: Bitcoin ETF Approval: What You Need to Know - cryptoS Report >> BTC, ETH & SOL...