How Bitcoin Beats Every Other Asset Class, According to MicroStrategy’s Michael Saylor

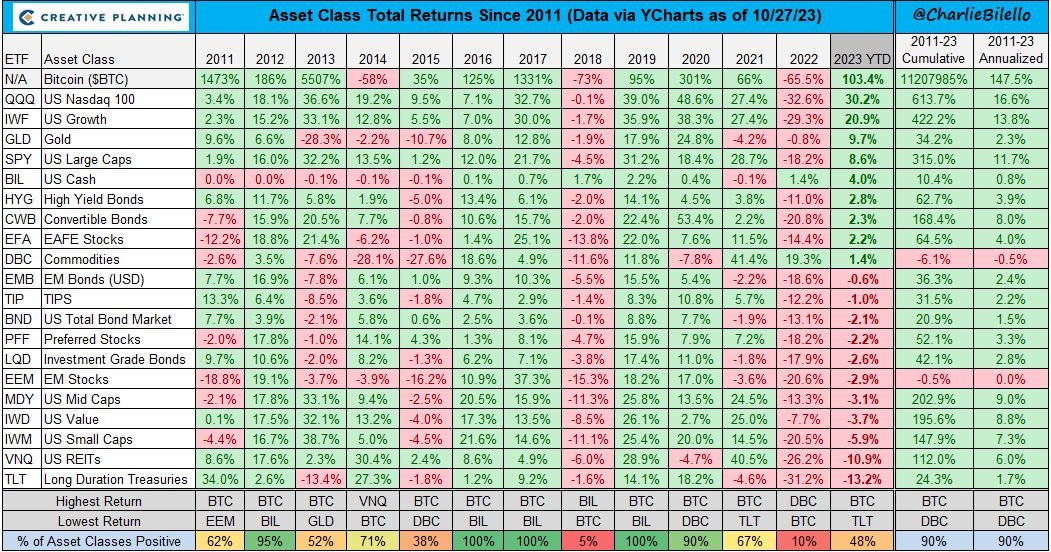

Bitcoin is not just the king of cryptocurrencies, it is also the best performing asset class in the world. That’s what Michael Saylor, the CEO of MicroStrategy and a vocal Bitcoin advocate, has shown with a stunning data sheet.

The sheet compares the total returns of different asset classes from 2011 to 2023, and Bitcoin comes out on top in almost every year. Bitcoin has delivered a staggering 1,120,785% cumulative return and a 147.5% annualized return in this period, leaving behind other assets like Nasdaq 100, U.S. Large Caps, Gold, and even Ethereum.

Saylor’s company, MicroStrategy, is one of the biggest institutional investors in Bitcoin. The firm currently holds 158,245 BTC, worth about $5.43 billion at the time of writing. MicroStrategy has been buying Bitcoin consistently since August 2020, taking advantage of the dips and profiting from the surges.