How Korean Crypto Investors Behave Differently from the Global Market

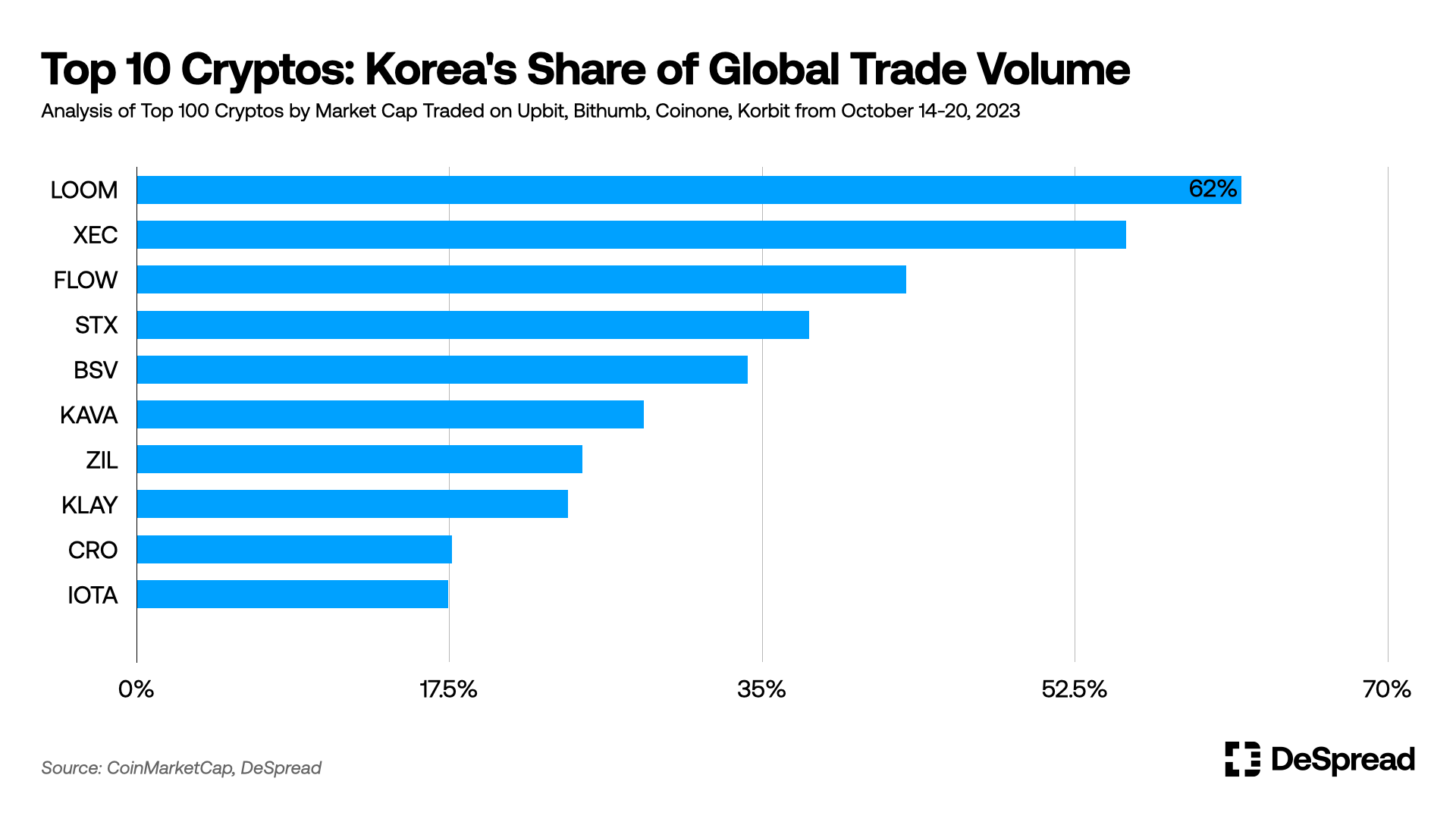

The Korean crypto market is one of the most active and influential markets in the world, with over 6 million investors accounting for more than 10% of the total population. However, the Korean crypto investors have some distinctive characteristics and preferences that set them apart from the global market. We will explore some of these differences based on the data analysis of the four major Korean centralized exchanges (CEX): Upbit, Bithumb, Coinone, and Korbit.

Upbit Dominates the Market with Altcoin Preference

Upbit is the undisputed leader of the Korean CEX market, with a consistent market share of around 80% of the total trading volume. Upbit’s dominance is largely driven by its strong focus on altcoins, which are cryptocurrencies other than Bitcoin and Ethereum. Upbit offers more than 200 altcoins for trading, while its competitors offer less than 100. Upbit’s investors are also more willing to take risks and pursue high returns by trading altcoins, which tend to have higher volatility and lower liquidity than Bitcoin and Ethereum.

In contrast, Coinbase, the leading US CEX, has a more conservative approach to crypto trading, with Bitcoin and Ethereum accounting for a large portion of its trading volume. Coinbase’s trading volume is also heavily influenced by institutional investors, who tend to prefer stable and established cryptocurrencies over speculative and experimental ones. Coinbase’s institutional investors make up about 85% of its total trading volume, according to its Q2 shareholder letter.

Bithumb’s Fee-Free Policy Fails to Boost Its Market Share

Bithumb, the second-largest Korean CEX, recently implemented a fee-free policy for all its trading pairs, hoping to attract more customers and increase its market share. The policy took effect on October 4th and initially showed some positive results. Bithumb’s trading volume increased and its market share rose above 20% for the first time in months.

However, the fee-free policy did not last long and Bithumb’s market share soon returned to its previous level of around 15%. This suggests that Korean crypto investors are not swayed by the fee factor alone when choosing a CEX. They may also consider other factors such as security, user experience, customer service, and coin selection. Moreover, the fee-free policy may not be sustainable for Bithumb in the long run, as it may erode its main source of revenue and compromise its profitability.

Ripple’s Legal Victory Sparks a Surge in Korean CEX Trading Volume

One of the most notable events that affected the Korean CEX market this year was Ripple’s partial victory in its lawsuit against the US Securities and Exchange Commission (SEC). Ripple is the company behind XRP, one of the most popular cryptocurrencies in Korea. On July 13th, a US judge ruled that Ripple could access some of the SEC’s internal documents regarding its views on Bitcoin and Ethereum. This was seen as a favorable outcome for Ripple, as it could potentially prove that XRP is not a security and should not be subject to SEC regulation.

The news triggered a massive rally in XRP’s price and trading volume, especially in Korea. XRP’s price soared by 80% and its trading volume surged by more than 10 times on that day. As a result, the total trading volume of the four Korean CEXs jumped from $27 billion in June to $37 billion in July, an increase of 37%. This shows how sensitive and responsive the Korean crypto market is to Ripple-related news and events.

Conclusion