Bitcoin difficulty metric reaches new peak amid mining recovery

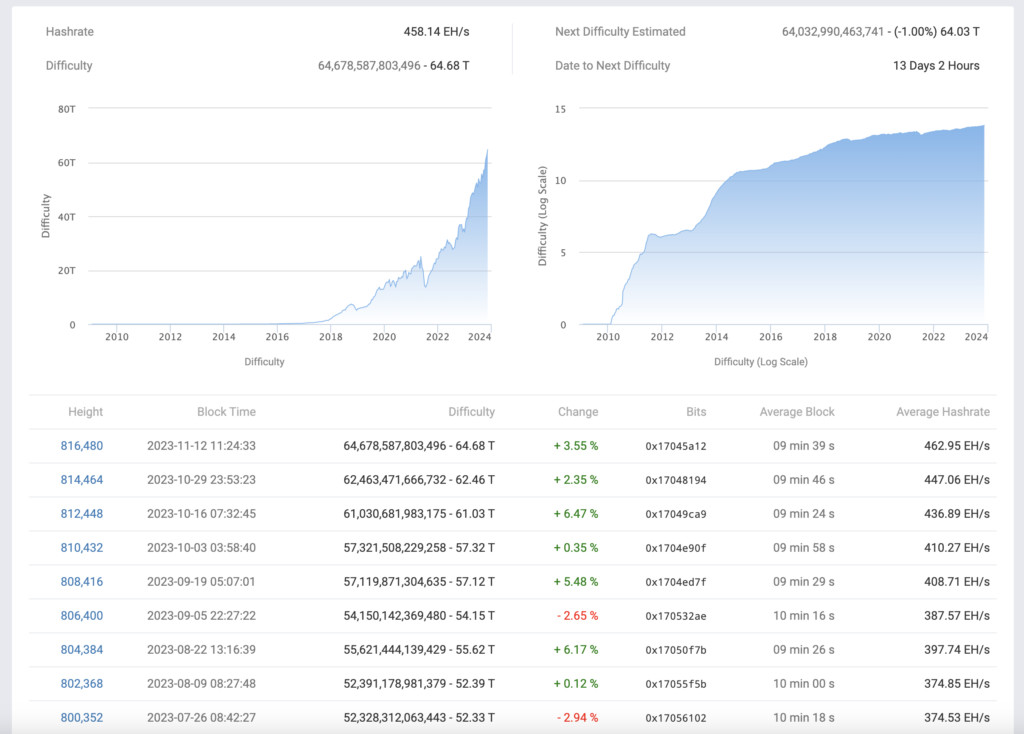

Bitcoin achieved a remarkable milestone on Sunday, November 12, 2023, as its difficulty metric increased by 3.55%, hitting a record high of 64.68 trillion at block height 816,480. This is the fifth consecutive rise in Bitcoin difficulty since the significant 5.48% jump on September 19, reflecting the changing and challenging mining landscape.

The difficulty metric measures how hard it is to mine a Bitcoin block and earn the reward. It adjusts every 2,016 blocks, or roughly every two weeks, to keep the average block time at 10 minutes. A higher difficulty means that more computing power is required to find a valid hash below a given target, making the network more secure against attacks.

The difficulty adjustment is also influenced by the number of active miners on the network. When many miners join or leave the network, the difficulty changes accordingly to maintain the equilibrium. The recent difficulty increases indicate that more miners are returning to the network after the mass exodus caused by China’s crackdown in June.

The recovery of the mining sector is also evident in other metrics, such as the hash rate and the mining revenue. The hash rate, which represents the total computing power of the network, has rebounded from its low of 69 exahashes per second (EH/s) in June to over 150 EH/s in November, according to Blockchain.com. The mining revenue, which measures the total income earned by miners, has also surged from $13 million per day in June to over $50 million per day in November, according to Coin Metrics.

The rising difficulty, hash rate, and revenue show that Bitcoin mining is becoming more competitive and profitable, attracting new and existing players to the industry. Some of the factors that contribute to this trend are the availability of cheap and renewable energy sources, the innovation of more efficient and powerful mining hardware, and the diversification of the mining locations across the globe.