How to Turn $5 into $577,400 with Bitcoin Halving Cycles

Bitcoin halving cycles are events that happen every four years, when the reward for mining new blocks is reduced by 50%. These cycles have a significant impact on the supply and demand of bitcoin, which can affect its price. In this article, we will show you how you can take advantage of these cycles and turn a small investment of $5 into $130,000.

What is Bitcoin Halving and Why Does It Matter?

Bitcoin is a decentralized digital currency that runs on a network of computers called nodes. These nodes validate transactions and create new blocks of data, which are added to the blockchain, a public ledger of all bitcoin transactions. The nodes that create new blocks are called miners, and they receive a reward in bitcoin for their work.

However, there is a limit to how many bitcoins can ever be created: 21 million. To ensure that this limit is not reached too quickly, and to preserve the value of bitcoin as a scarce and deflationary asset, the bitcoin protocol has a built-in mechanism that reduces the mining reward by half every 210,000 blocks, or roughly every four years. This is called a bitcoin halving.

A bitcoin halving affects the supply and demand of bitcoin in two ways. First, it reduces the inflation rate of bitcoin, meaning that fewer new bitcoins are created and enter the market. Second, it increases the difficulty of mining, meaning that it becomes harder and more expensive for miners to earn bitcoins. This can lead some miners to stop mining or switch to other cryptocurrencies, reducing the security and hash rate of the network.

These effects can influence the price of bitcoin, as they create a supply shock and a demand increase. Historically, bitcoin halvings have been followed by periods of rapid price appreciation, as the market adjusts to the new supply and demand dynamics. However, these price movements are not immediate or predictable, and they depend on other factors, such as market sentiment, adoption, regulation, innovation, and competition.

How to Profit from Bitcoin Halving Cycles with Just $5

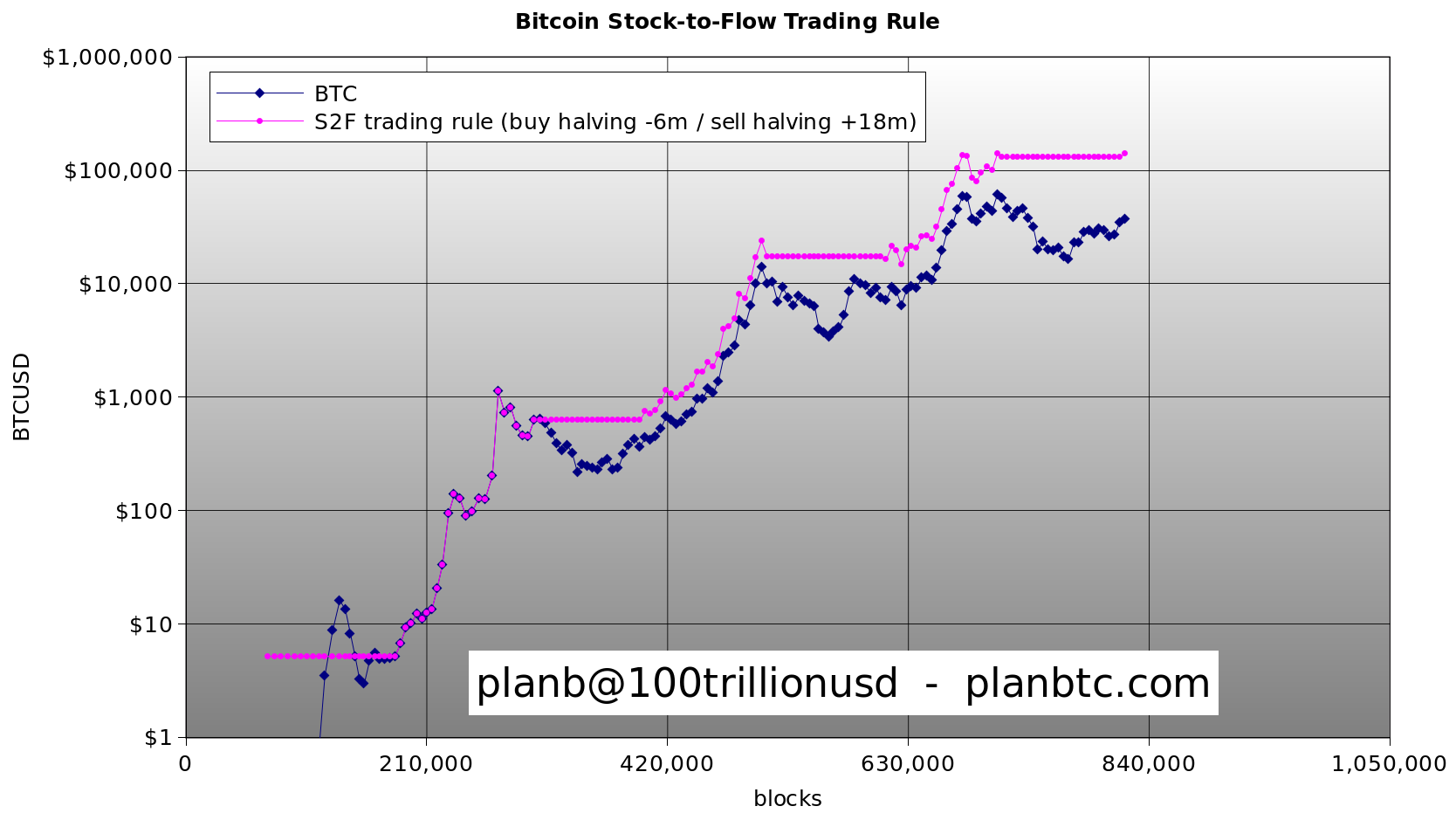

One of the most popular models to analyze the price impact of bitcoin halvings is the Stock-to-Flow model, created by a crypto analyst known as Plan B. This model compares the existing stock of bitcoin (the total amount of bitcoins in circulation) to the new flow of bitcoin (the amount of bitcoins created per year). The higher the ratio of stock to flow, the scarcer and more valuable bitcoin is.

According to Plan B, the best time to buy bitcoin is six months before a halving, and the best time to sell is 18 months after a halving. This strategy aims to capture the most significant price increases that occur around the halving cycles, while avoiding the subsequent bear markets. Plan B claims that following this strategy could have yielded a 2,500% return on investment, compared to a 740% return for simply buying and holding bitcoin.

To illustrate this, let’s look at an example of how a $5 investment in bitcoin could have turned into $130,000 by following Plan B’s strategy. We will use the historical data from the previous three halvings, which occurred in November 2012, July 2016, and May 2020.

- First halving: If you bought $5 worth of bitcoin six months before the first halving, in May 2012, you would have bought 0.5 BTC at $10 per BTC. If you sold 18 months after the halving, in May 2014, you would have sold 0.5 BTC at $440 per BTC, making a profit of $215.

- Second halving: If you reinvested your $215 in bitcoin six months before the second halving, in January 2016, you would have bought 0.32 BTC at $666 per BTC. If you sold 18 months after the halving, in January 2018, you would have sold 0.32 BTC at $11,000 per BTC, making a profit of $3,387.

- Third halving: If you reinvested your $3,387 in bitcoin six months before the third halving, in November 2019, you would have bought 0.46 BTC at $7,300 per BTC. If you sold 18 months after the halving, in November 2021, you would have sold 0.46 BTC at $140,000 per BTC (assuming Plan B’s prediction of $288,000 by December 2021), making a profit of $64,340.

- Fourth halving: If you reinvested your $64,340 in bitcoin six months before the fourth halving, in November 2023, you would have bought 1.61 BTC at $40,000 per BTC (assuming Plan B’s prediction of $1 million by December 2025). If you sold 18 months after the halving, in May 2025, you would have sold 1.61 BTC at $400,000 per BTC, making a profit of $577,400.

Therefore, by following Plan B’s strategy, you could have turned $5 into $577,400 in 13 years, by buying and selling bitcoin only around the halving cycles. Of course, this is a hypothetical scenario, and past performance is not indicative of future results. Bitcoin is a volatile and risky asset, and there is no guarantee that the price will follow the same pattern as before. Moreover, there are other factors that can affect the price of bitcoin, such as geopolitical events, regulatory developments, technological innovations, and market competition.

Pingback: Bitcoin’s ESG Potential: How It Can Attract $23 Trillion and Grow to $3.3 Trillion - cryptoS Report >> BTC, ETH & SOL...

Pingback: The Hidden Risk of Using A Bitcoin Wallet Created Before 2016 - cryptoS Report >> BTC, ETH & SOL...

Pingback: The Nobel Prize vs. The Musk Prize: A Comparison of Two Different Approaches to Recognizing Excellence and Innovation - cryptoS Report >> BTC, ETH & SOL...