Bitcoin Could Hit $141,000 in One Year, According to CoinShares Model

Bitcoin (BTC), the leading cryptocurrency by market capitalization, has been on a remarkable rally since the start of the year, reaching new all-time highs at $38,000. Many analysts and investors are wondering how high BTC can go in the future, and what factors could drive its price growth.

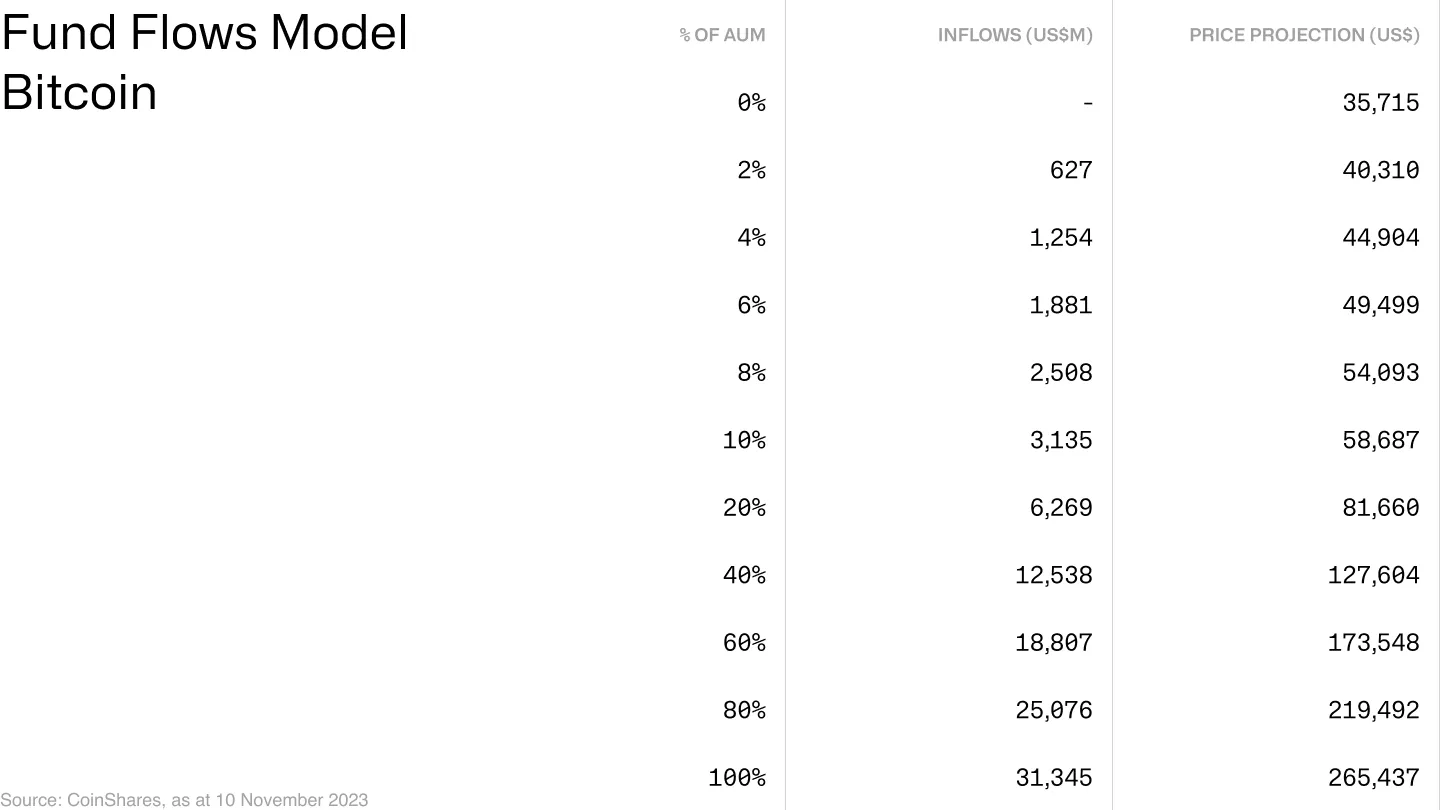

One of the most bullish predictions comes from CoinShares, a digital asset investment firm that manages over $4 billion in assets. CoinShares has developed a valuation model for Bitcoin based on its scarcity, adoption, and network effects. According to Coinshares model, Bitcoin could reach $141,000 in one year, assuming a constant supply growth rate of 1.8% and a constant demand growth rate of 20%.

The model is based on the idea that Bitcoin is a digital commodity that has a fixed supply of 21 million coins, and that its value is determined by the balance between supply and demand. The supply side is influenced by the mining reward halving events, which reduce the amount of new bitcoins created every four years. The demand side is influenced by the number of users, transactions, and holders of Bitcoin, as well as the market capitalization of other digital assets.

The model also incorporates the network effects of Bitcoin, which means that the value of the network increases as more people join and use it. The network effects are measured by the Metcalfe’s law, which states that the value of a network is proportional to the square of the number of its nodes. CoinShares estimates that Bitcoin has over 100 million active users, and that this number could grow to over 1 billion in the next decade.

CoinShares acknowledges that its model is not perfect, and that there are many uncertainties and challenges that could affect Bitcoin’s price in the future. Some of these include regulation, competition, innovation, security, and environmental concerns. However, the firm believes that its model provides a useful framework for understanding Bitcoin’s potential and value proposition.

Pingback: The Bitcoin Model That Nailed the $60K Peak Now Foresees a $732K Future - cryptoS Report >> BTC, ETH & SOL...