Standard Chartered Predicts $100K Bitcoin Price with Spot ETF Approval

Standard Chartered, a major British bank, has shared its bullish outlook on Bitcoin if the U.S. Securities and Exchange Commission (SEC) approves spot Bitcoin exchange-traded funds (ETFs). Spot Bitcoin ETFs are investment vehicles that track the current price of Bitcoin without using derivatives contracts.

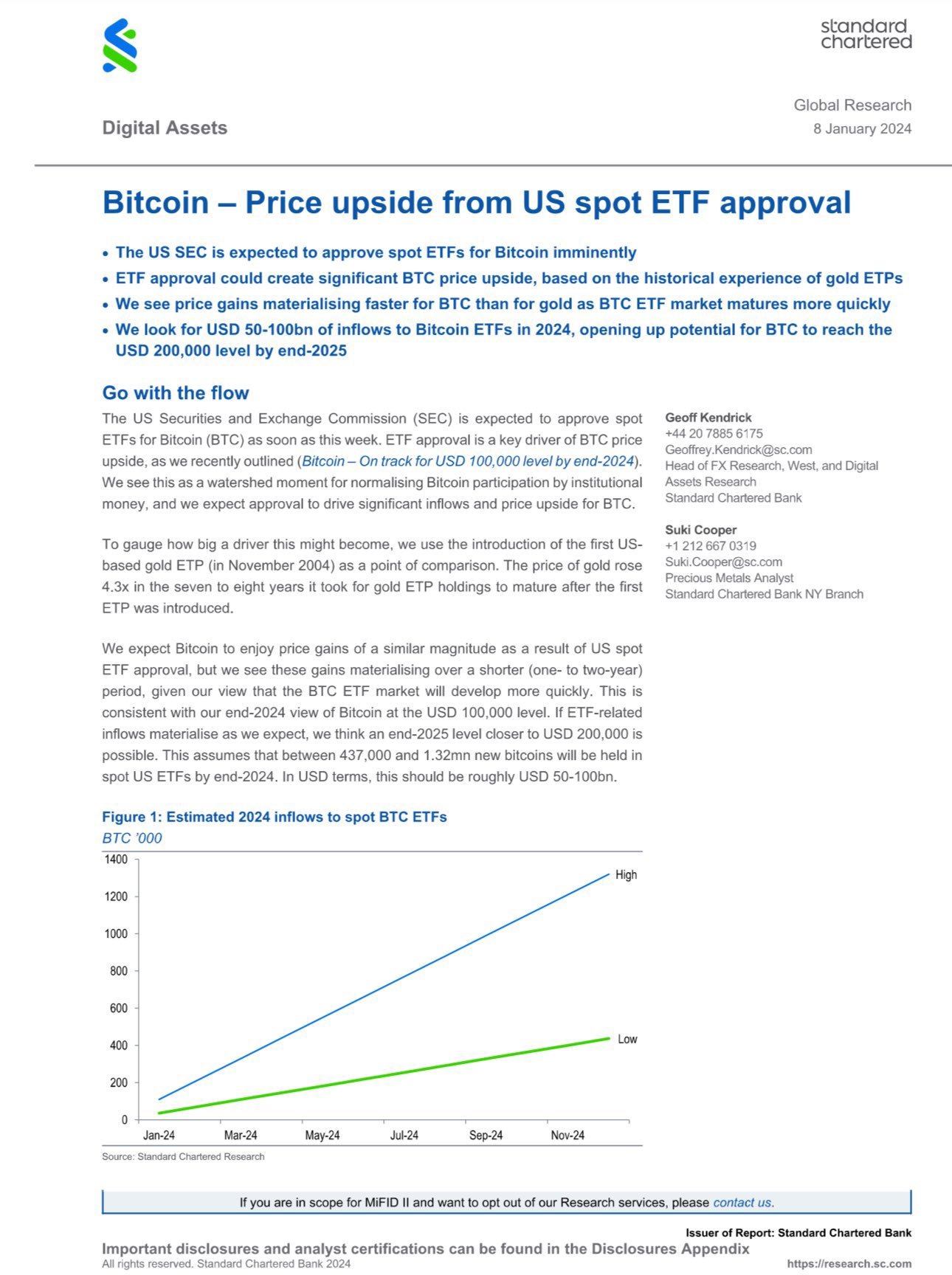

According to a research note by Standard Chartered, the approval of spot Bitcoin ETFs could be a “bigger-than-expected catalyst” for the cryptocurrency market, as it would attract more institutional and retail investors to the space. The bank estimates that Bitcoin could reach $100,000 by the end of 2024 if spot ETFs are approved, and even higher if the adoption rate increases.

The bank also notes that spot Bitcoin ETFs would have several advantages over futures-based ETFs, which are the only type of Bitcoin ETFs currently available in the U.S. Futures-based ETFs incur higher costs due to the need to roll over contracts periodically, and they may not reflect the true price of Bitcoin due to the futures premium or discount. Spot Bitcoin ETFs, on the other hand, would hold actual bitcoins in a secure digital vault, and their share price would closely mirror the spot price of Bitcoin.

However, the approval of spot Bitcoin ETFs is not guaranteed, as the SEC has been reluctant to greenlight them due to concerns over market manipulation, custody, and investor protection. The SEC has rejected several applications for spot Bitcoin ETFs in the past, and it has recently delayed its decision on several more. The SEC has until February 14, 2024, to make a final decision on the spot Bitcoin ETF application by VanEck, one of the leading contenders in the race.

If the SEC approves spot Bitcoin ETFs, it would be a major milestone for the crypto industry, as it would signal a higher level of regulatory acceptance and legitimacy for Bitcoin as an investable asset. It would also open the door for more innovation and competition in the crypto ETF space, as more issuers and products would enter the market. Some of the potential benefits of spot Bitcoin ETFs for investors include:

- Easier and safer access to Bitcoin exposure without having to buy, store, or manage bitcoins directly

- Lower fees and expenses compared to futures-based ETFs or other alternatives

- Higher liquidity and transparency due to trading on major stock exchanges

- Diversification and risk management benefits due to the low correlation of Bitcoin with other asset classes