Trillions of dollars of Tokenization in the coming years

Tokenization is a process of converting real-world assets into digital tokens, which can be traded and managed on blockchain-based platforms. Tokenization has the potential to disrupt traditional financial systems by enabling fractional ownership of assets, reducing transaction costs, and increasing liquidity.

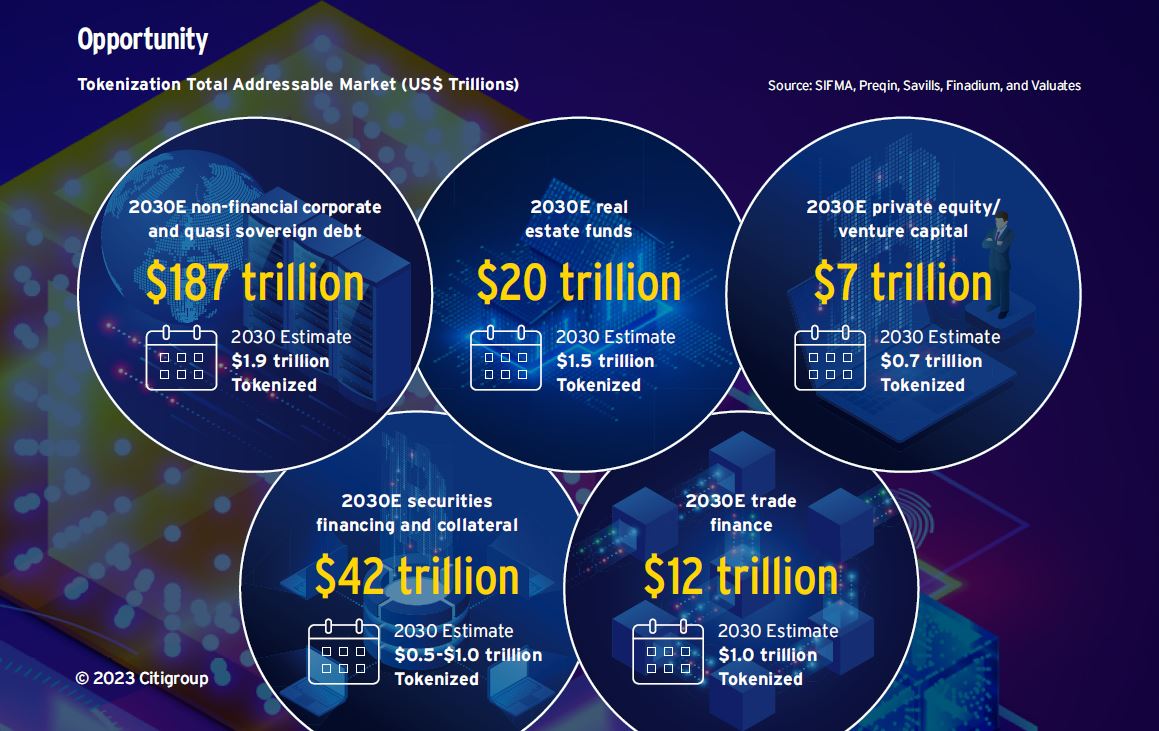

In a new Report from Citi Group “Money, Tokens, and Games: Blockchain’s Next Billion Users and Trillions in Value,”

“The potential for tokenization via blockchain has been talked about as being transformative for the past few years but we are not quite at the point of mass adoption. Unlike automobiles or more recent innovations like ChatGPT or the Metaverse, blockchain is a back-end infrastructure technology without a prominent consumer interface, making it harder to visibly see how it could be innovative.”

Citi analysts

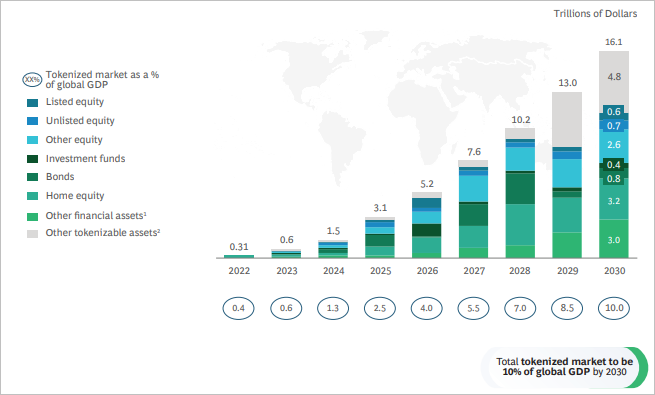

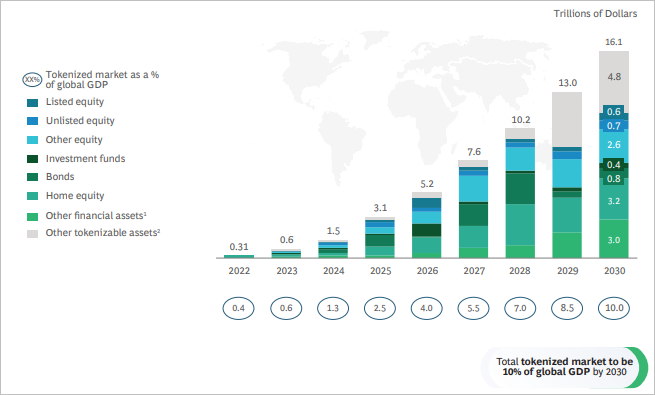

Plus another Report from Boston Consultant Group (BCG) “Relevance of on-chain asset tokenization in ‘crypto winter’“

The total size of illiquid asset tokenization globally would be $16 trillion by 2030.”

BCG

The value of tokenized assets is in hundreds of billions with the potential to go parabolic to trillions and tens of trillions by 2030. Those numbers are very conservative based on the geo-politics as it could be much higher if we collaborate globally putting aside our disagreements and unite to make the world a better place for more than 8 billions.

Stocks and bonds are also being tokenized. The tokenization of stocks and bonds could reduce transaction costs and increase liquidity in the capital markets. It could also enable fractional ownership of stocks and bonds, making it easier for small investors to invest in these assets.Tokenization could also enable the creation of new asset classes. For example, tokenized commodities such as gold, silver, and oil could be traded on blockchain-based platforms. This could open up new investment opportunities for investors.

Here is one of the best examples of tokenization that is close to everyone’s heart: Gold as it surpassed $1 Billion while Close To All-Time High due to uncertain time of national banking failures and global recession.

Digital #Gold, aka #Bitcoin, rallied in tandem w/analogue Gold. pic.twitter.com/tOH41oIKXi

— Holger Zschaepitz (@Schuldensuehner) April 4, 2023

Also BlackRock, the world’s largest asset management company is exploring as the CEO confirms:

“At BlackRock we continue to explore the digital assets ecosystem, especially areas most relevant to our clients such as permissioned blockchains and tokenization of stocks and bonds.” – Larry Fink said.

With billions of users and trillions in values, it is unstoppable with the Blockchain as we will see major changes in our lifetime. You have all the confidence as an investor to get in early and never too late. As alway, it’s about the time horizon and risk management of your finances and now all you need to to do is to secure your cryptoS responsibly!

In conclusion, tokenization has the potential to disrupt traditional financial systems and create new investment opportunities. Trillions of dollars’ worth of assets could be tokenized in the coming years, and the adoption of tokenization is expected to increase. As the tokenization market grows, we could see the emergence of new blockchain-based platforms and services that cater to the needs of investors.