The Ultimate Hedge Against War and Inflation: Bitcoin Explained by Arthur Hayes

Arthur Hayes, the former CEO of BitMEX, a leading crypto derivatives exchange, has shared his views on the recent rally of Bitcoin and the factors behind it. In a blog post titled “The Periphery”, Hayes argued that Bitcoin is not rising because of the approval of a spot ETF in the US, but rather because of the fears of global wartime inflation.

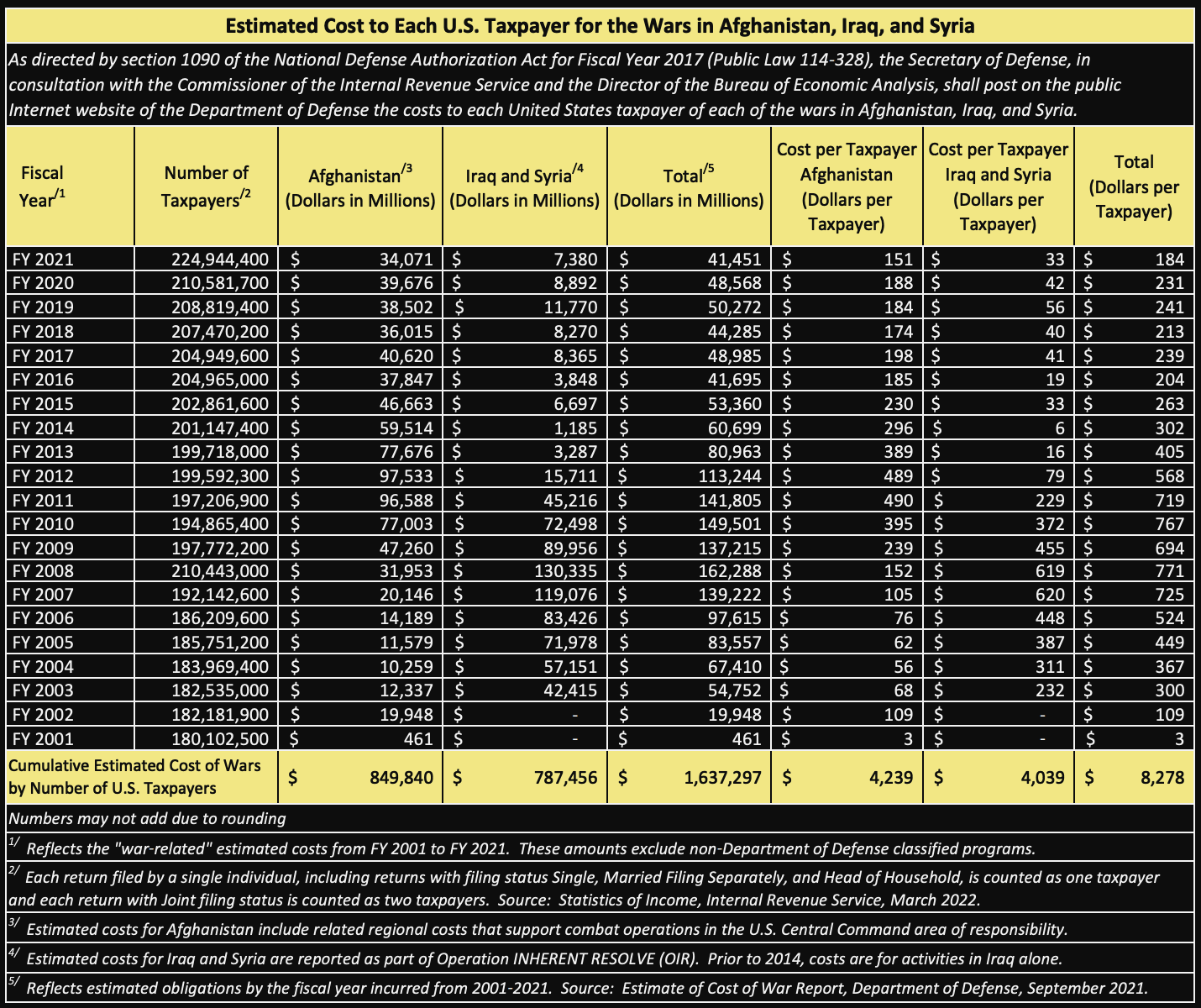

Arthur Hayes explained that the US and China are engaged in a cold war that could escalate into a hot one, especially over Taiwan. He said that both countries are increasing their military spending and preparing for a possible conflict. This, in turn, could lead to higher inflation and devaluation of fiat currencies.

He said that Bitcoin and gold are the best hedges against this scenario, as they are scarce and decentralized assets that cannot be manipulated by governments. He said that Bitcoin is superior to gold in terms of portability, security, and accessibility. He also said that Bitcoin is more attractive to younger generations who are more tech-savvy and distrustful of authorities.

Hayes predicted that Bitcoin could reach $750,000 to $1 million by 2026, based on several factors. He said that the eventual approval of a spot Bitcoin ETF in the US, Europe, and Hong Kong, as well as the halving event in 2024, could boost the demand and price of Bitcoin. He also said that Bitcoin could benefit from the adoption of the Lightning Network, which enables fast and cheap transactions on top of Bitcoin.