Why Bitcoin Price Dropped To $35,000 in a Flash Crash

Bitcoin price experienced a sudden and sharp decline in the last hour, breaking the $35,000 support level. What triggered this sell-off in the market? Bitcoin price lost about 3% of its value in the last hour, catching many traders and investors off guard. The cryptocurrency community is speculating about the possible reasons for this drop.

One Factor Could Be a Bloomberg Analyst’s Change of Tone on Bitcoin Spot ETFs

Some analysts have pointed to the recent comments by James Seyffart, a Bloomberg Intelligence analyst, who had previously expressed optimism about the approval of Bitcoin spot ETFs this week. His bullish remarks had contributed to the rally that pushed Bitcoin price above $38,000 earlier this week.

At the time of writing, Bitcoin price has bounced back slightly after dipping below $35,000 and is trading around $35,400. Chart showing the plunge in Bitcoin price in the last hour.

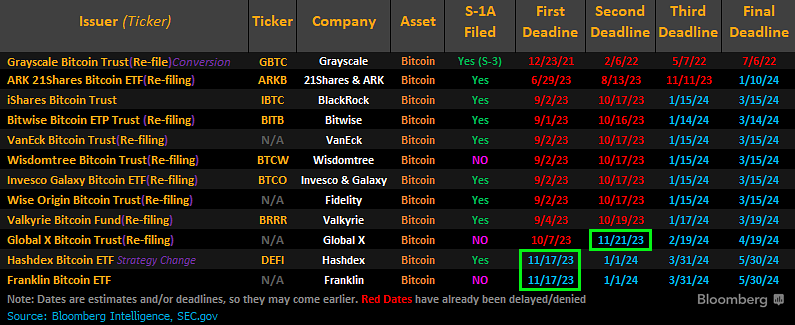

In his latest update, Seyffart noted that three of the Bitcoin spot ETF applications are facing imminent deadlines for the SEC to make a decision. The SEC has until Friday, November 17, to rule on the Hashdex and Franklin Bitcoin ETFs, and until Tuesday, November 21, to act on the Global X Bitcoin Trust product.

However, contrary to his previous statements, Seyffart said that he no longer expects approval this week and predicted that the decisions would most likely be delayed. He added that Bloomberg analysts still believe there is a 90% chance of approval of Bitcoin spot ETFs by January 10.

Another analyst, Nate Geraci, challenged Seyffart on his changed stance and asked him if he still thinks approval will come this week. Seyffart replied that approval could either come around Jan. 10, or if the theory that all approvals will come together is wrong, the other nine applicant firms could get the green light in the following months.

He also suggested that another possibility is that all applications could be denied. How Bitcoin Spot ETFs Could Impact the Market Bitcoin spot ETFs are investment vehicles that would allow mainstream investors to gain exposure to the actual price of Bitcoin, rather than its futures contracts.

Unlike Bitcoin futures ETFs, which are already trading in the U.S., spot ETFs would hold physical bitcoins in secure custody and track their price movements directly. Many experts believe that Bitcoin spot ETFs would be more beneficial for the market, as they would increase the demand and liquidity for the underlying asset, improve the price discovery and efficiency, and reduce the premium or discount issues that often plague futures-based products.

Moreover, spot ETFs would offer a simpler and more regulated way for investors to access Bitcoin, without the hassle and risk of buying and storing it themselves. The approval of Bitcoin spot ETFs by the SEC is widely seen as a major milestone for the crypto industry, as it would signal the regulator’s recognition and acceptance of Bitcoin as a legitimate asset class. It could also boost the confidence and adoption of Bitcoin among institutional and retail investors, potentially driving its price higher in the long term.

However, the approval of Bitcoin spot ETFs is not guaranteed, as the SEC has repeatedly expressed concerns about the risks of fraud and manipulation in the crypto market, as well as the lack of adequate surveillance and oversight. The SEC has rejected every application for a spot Bitcoin ETF so far, and has delayed or extended its review of several others.

Therefore, investors should be cautious and not rely on speculation or rumors about the approval of Bitcoin spot ETFs, as they could lead to disappointment and volatility in the market. Instead, investors should focus on the fundamentals and long-term trends of Bitcoin, which remain strong and positive.

*This is not investment advice. Please do your own research before investing in any cryptocurrency.*