Crypto Is the New Alternative: Institutional Investors Plan to Increase Their Exposure in the Next Three Years

A new survey commissioned by Coinbase, the leading US crypto exchange, reveals that institutional investors are optimistic about the future of cryptocurrencies and plan to increase their exposure to the asset class.

The survey, conducted by the business-to-business firm Institutional Investor, polled a “representative sample” of 250 institutional investors, including hedge funds, family offices, endowments, foundations, and pension funds.

The results show that 57% of the respondents believe that crypto prices will go up in the next 12 months, a significant increase from only 8% who had the same view in Coinbase’s survey last year. Only 2% of the investors expect crypto to trend lower in the next year, while 41% think it will stay flat or range-bound.

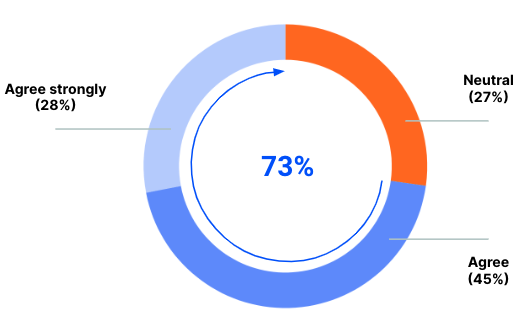

The survey also indicates that institutional investors are becoming more interested in crypto as an alternative asset class that can offer attractive risk-adjusted returns. Nearly 60% of the respondents say they plan to increase their crypto allocations over the next three years, and none of them say they intend to decrease their holdings.

Moreover, almost half of the institutional investors who do not have any crypto exposure yet say they are likely to enter the space in the next three years.

When asked about the asset classes that they see as the biggest opportunities to generate attractive risk-adjusted returns in the next three years, 54% of the respondents say private equity, 48% say U.S. equities, 41% say cryptocurrencies, and 35% say emerging market equities. On the other hand, only 31% say commodities and 26% say real estate.

Pingback: Bitcoin Outperforms Ethereum in Daily Fees - cryptoS Report >> BTC, ETH & SOL...

Pingback: Aimbot: The Ultimate Passive Income Machine for Crypto Lovers - cryptoS Report >> BTC, ETH & SOL...

Pingback: The Rise of Blur: The Fastest and Most Innovative NFT Marketplace in the World - cryptoS Report >> BTC, ETH & SOL...